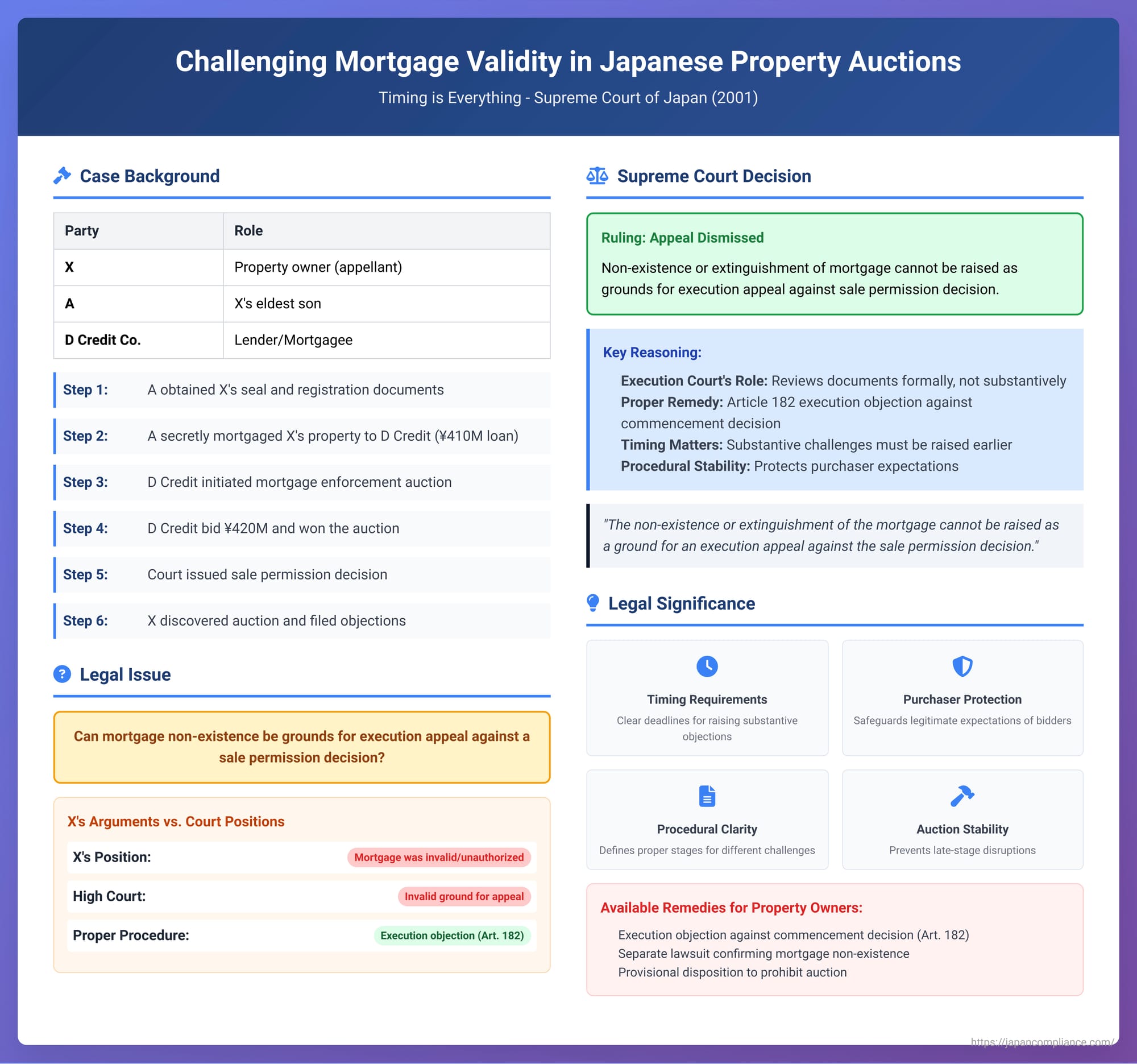

Challenging Mortgage Validity in Japanese Property Auctions: Timing is Everything

When a lender initiates a real property auction in Japan to enforce a mortgage—a process known as "security interest execution" (担保権実行 - tanpoken jikkō)—the property owner (debtor or a third-party guarantor) may believe the mortgage itself is non-existent or has been extinguished (e.g., through repayment). A critical question arises: at what stage, and through what procedure, can the owner raise such fundamental challenges to the validity of the mortgage? Specifically, if the auction has already progressed to the point where the court issues a "sale permission decision" (売却許可決定 - baikyaku kyoka kettei) confirming the sale to the highest bidder, can the owner still appeal this decision by arguing that the underlying mortgage is invalid? A 2001 Supreme Court of Japan decision provided a definitive answer, emphasizing that such substantive challenges must be raised earlier in the proceedings.

Background of the Dispute

The appellant, X, was the owner of the real property in question (the "Property"). X had entrusted the Property's registration certificate, X's official seal (実印 - jitsuin), and seal registration card to X's eldest son, A, who lived with X.

A became involved in a series of financial dealings. Initially, A acted as a joint guarantor for a loan taken by an acquaintance (the president of B Company) from C Bank, and also provided land jointly inherited by X and A as security for this guarantee. Later, when B Company defaulted and A was pressed to fulfill the guarantee obligation, A sought a new loan of 410 million yen from D Credit Company.

A crucial point of contention was that A, allegedly anticipating that X would not consent to mortgaging the Property in Question for this new loan from D Credit Company, proceeded to conclude the loan agreement and a mortgage agreement with D Credit Company without X's knowledge or permission. A mortgage in favor of D Credit Company was subsequently registered on the Property.

Later, D Credit Company initiated a mortgage enforcement auction against the Property based on this allegedly unauthorized mortgage. An auction commencement decision was issued by the court. D Credit Company itself participated in the auction, bid 420 million yen, and was declared the highest bidder. Consequently, the execution court issued a "sale permission decision" confirming the sale of the Property to D Credit Company.

It was only after D Credit Company had made its successful bid that X became aware of the auction proceedings. X immediately took action, asserting that X had never consented to the creation of the mortgage by A in favor of D Credit Company, and therefore, the mortgage registration was invalid. X filed an "execution objection" (執行異議 - shikkō igi) against the initial auction commencement decision. Additionally, X filed an "execution appeal" (執行抗告 - shikkō kōkoku) against the subsequent sale permission decision, citing the same reason: the non-existence or invalidity of the mortgage.

The High Court, when reviewing X's execution appeal against the sale permission decision, dismissed it. The High Court held that the non-existence or invalidity of the underlying security interest (the mortgage) is not a legally permissible ground for an execution appeal against a sale permission decision. X then sought and was granted permission to appeal this specific ruling to the Supreme Court of Japan.

The Supreme Court's Decision

The Supreme Court of Japan dismissed X's appeal, thereby upholding the High Court's decision. The Supreme Court laid down a clear rule:

In a real property auction conducted as an enforcement of a mortgage (as defined in Article 43, Paragraph 1 of the Civil Execution Act, including property deemed as real property under Article 43, Paragraph 2), the non-existence or extinguishment of the mortgage cannot be raised as a ground for an execution appeal against the sale permission decision.

The Court provided the following reasoning for this conclusion:

- Execution Court's Role at the Commencement of Auction: When a creditor applies to initiate a mortgage enforcement auction, the execution court is mandated to commence the procedure if the prescribed documents, such as a certified copy of the land register showing the mortgage registration, are submitted (as per Article 181 of the Civil Execution Act). The court, at this initial stage, does not undertake a substantive investigation into the actual existence or validity of the mortgage itself. It relies on the formal documentary evidence.

- Proper Remedy for Substantive Objections to the Mortgage: The Civil Execution Act provides a specific mechanism for challenging the existence or validity of the mortgage. Article 182 of the Act explicitly allows the debtor or owner to raise the non-existence or extinguishment of the security interest as a ground for an execution objection against the auction commencement decision.

- Conclusion on Permissible Grounds for Appeal: Therefore, the Supreme Court reasoned, if a party wishes to assert that a mortgage is non-existent or has been extinguished in the context of a real property auction, they must use the execution objection procedure against the auction commencement decision. The non-existence or extinguishment of the mortgage does not constitute a valid reason for refusing to permit the sale under Article 71, item 1 of the Civil Execution Act (applied to security auctions via Article 188), which refers to "circumstances under which the real property auction procedure should not have been commenced or continued." Such substantive defects in the mortgage are to be addressed at the earlier stage.

The Supreme Court also noted that this ruling did not conflict with older precedents from the Great Court of Cassation (Japan's pre-WWII highest court), which operated under a different legal framework (the old Auction Act).

Significance and Analysis of the Decision

This 2001 Supreme Court decision is a crucial clarification regarding the procedural stages at which different types of objections can be raised in mortgage enforcement auctions in Japan. It effectively bars what is sometimes termed a "substantive appeal" (実体抗告 - jittai kōkoku)—an appeal based on substantive defects of the security interest itself—at the late stage of a sale permission decision.

- Balancing Competing Interests: Mortgage enforcement auctions involve balancing several interests. On one hand, the auction is theoretically based on the "power of realization inherent in the security interest," so the non-existence of the mortgage is a fundamental issue. On the other hand, once an auction progresses to a sale permission decision, the successful bidder has a legitimate expectation of acquiring title, and their interests also require protection. An "execution appeal" is primarily a tool to challenge procedural flaws in the execution court's dispositions and is allowed only under specific statutory conditions.

- Shift from Old Law: Under the old Auction Act (abolished with the enactment of the Civil Execution Act in 1979), both case law and prevailing academic theory had generally permitted an immediate appeal against the auction permission (sale) decision based on the non-existence or extinguishment of the underlying security interest. The Civil Execution Act established a new framework. While Article 74(1) (applied via Article 188) allows an execution appeal against a sale permission decision, the permissible grounds are specified in Article 71. The central question this case resolved was whether the non-existence of a mortgage falls within Article 71(1)'s ground that the "procedure should not have been commenced or continued." The Supreme Court answered this in the negative for appeals against the sale permission decision.

- The "Documentary Evidence Theory" (書証説 - shoshō setsu) in Practice: The "Documentary Evidence Theory," which is now dominant in practice, posits that these documents are not quasi-titles of obligation themselves but rather specified forms of evidence that the execution court examines to quickly ascertain the prima facie existence of the security interest before commencing the auction. This theory aligns with the structure of the Civil Execution Act, which allows the debtor/owner to raise substantive objections (like the non-existence of the mortgage) against the commencement decision itself via an execution objection under Article 182. The Supreme Court's decision is consistent with this understanding.

- Rationale for Denying Substantive Appeals at the Sale Permission Stage: The shift in academic opinion towards denying such late-stage substantive appeals (the "negative theory") is based on several reasons:

- Availability of Earlier Remedies: The debtor/owner has the opportunity to file an execution objection against the auction commencement decision under Article 182. This objection has no strict time limit and can, in principle, be filed even after a sale permission decision has been rendered, as long as the purchaser has not yet paid the price. Additionally, the debtor/owner can file a separate substantive lawsuit to confirm the non-existence of the mortgage and simultaneously seek a provisional disposition from the court to prohibit or suspend the ongoing auction procedure.

- Preventing Abuse and Delays: Allowing substantive challenges to the mortgage at the late stage of appealing a sale permission decision could encourage abusive appeals aimed solely at delaying the inevitable. Execution appeals, even if ultimately unsuccessful, can significantly stall the proceedings.

- Protecting the Purchaser's Interests: Once a sale permission decision is issued, the highest bidder (purchaser) develops a strong and legitimate expectation of acquiring the property. Permitting the auction to be overturned at this stage based on grounds that could have been raised earlier would undermine the stability and reliability of the auction system.

- Available Remedies for the Debtor/Property Owner: Given this ruling, if a property owner believes a mortgage being enforced against their property is non-existent or has been extinguished, their primary recourse within the execution procedure is to file an execution objection against the auction commencement decision pursuant to Article 182 of the Civil Execution Act. If this objection is upheld by the execution court, the court can order the stay of the execution and the cancellation of any execution measures already taken (Article 183(1)(v) and (2)).

Alternatively, and often more robustly, the owner can initiate a separate substantive lawsuit to seek a declaratory judgment confirming the non-existence of the security interest (担保権不存在確認訴訟 - tanpoken fusonzai kakunin soshō). In conjunction with this lawsuit, they can apply for a provisional disposition (injunction) to prohibit the continuation of the mortgage enforcement auction (担保権実行禁止の仮処分 - tanpoken jikkō kinshi no karishobun). If granted, the order from this provisional disposition can be submitted to the execution court as a document requiring the auction to be stopped (Article 183(1)(vii)).

Submitting this to the execution court can also stop the auction (Article 183(1)(iv)). However, it notes a practical concern: if such a cancellation certificate is submitted after a highest bid has been accepted but before the purchaser has paid the price, and if this appears to be a strategic maneuver to unfairly nullify a legitimate sale outcome (e.g., through collusive action between the debtor and mortgagee after seeing a high bid), courts have invoked the doctrine of abuse of rights to refuse to cancel the auction procedure.

It is important to note that once the sale permission decision becomes final and the purchaser pays the purchase price, ownership of the property generally transfers to the purchaser, and the non-existence or extinguishment of the mortgage typically cannot then undo this transfer (Civil Execution Act, Article 184).

Conclusion

The 2001 Supreme Court decision provides a clear directive on the proper timing and method for challenging the substantive validity of a mortgage in the context of an enforcement auction in Japan. It firmly establishes that objections based on the non-existence or extinguishment of the mortgage must be raised primarily through an "execution objection" against the auction commencement decision. Such grounds cannot be used as a basis for an "execution appeal" against the sale permission decision. This ruling prioritizes the stability of the auction process once it reaches an advanced stage and protects the legitimate expectations of purchasers, while ensuring that property owners have adequate—albeit earlier—opportunities to assert their substantive rights. It underscores the importance for debtors and property owners to act promptly if they believe a mortgage enforcement action is unfounded.