Bankruptcy Trustee's Tax Duties: Japanese Supreme Court on Withholding from Fees and Employee Payouts

Date of Judgment: January 14, 2011

Case Name: Claim for Confirmation of Non-Existence of Withholding Income Tax Payment Obligation (平成20年(行ツ)第236号)

Court: Supreme Court of Japan, Second Petty Bench

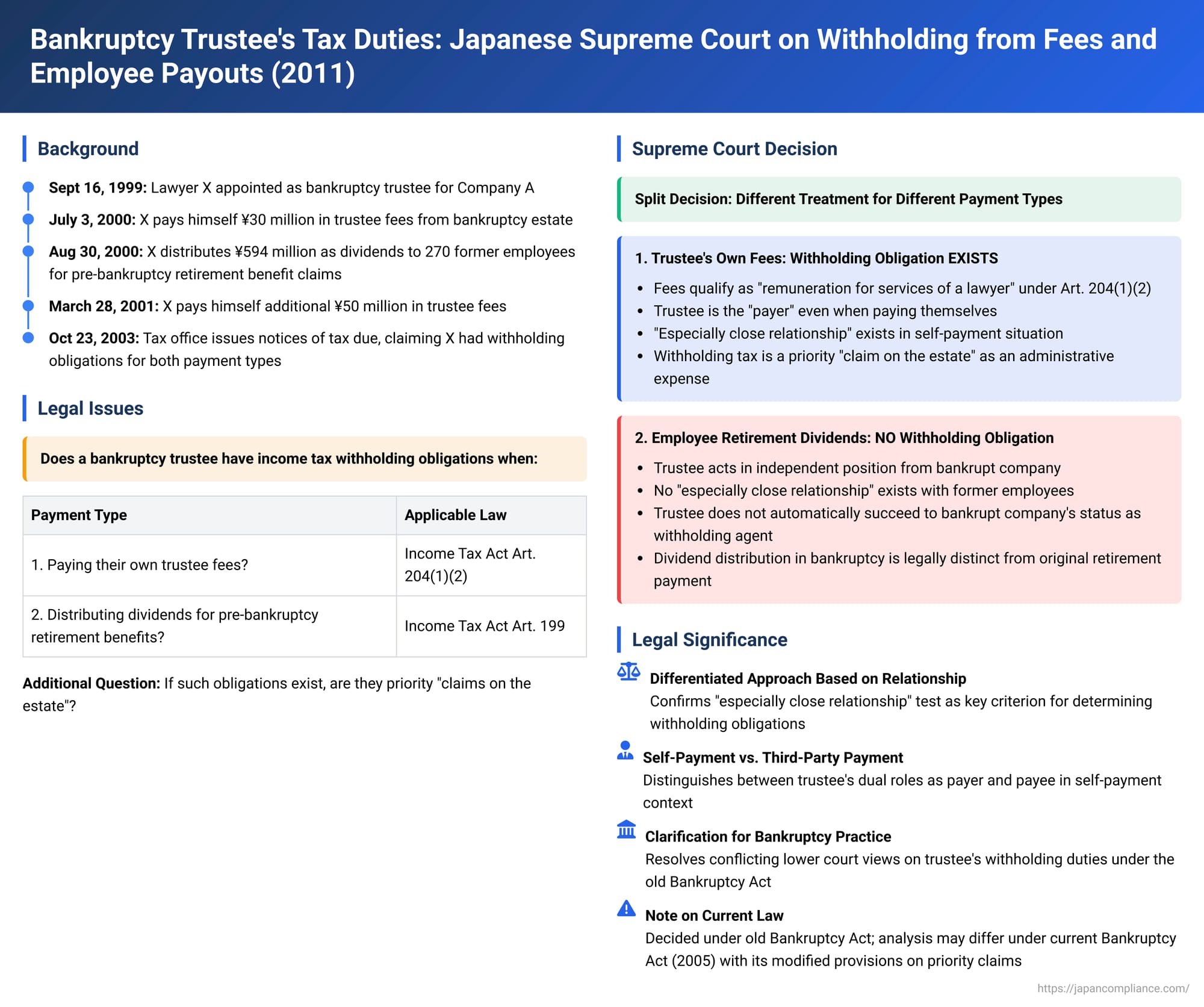

In a significant judgment on January 14, 2011, the Supreme Court of Japan clarified the scope of an income tax withholding obligation for a bankruptcy trustee operating under Japan's old Bankruptcy Act (Law No. 75 of 2004, prior to its full repeal and replacement). The case specifically addressed whether a trustee, who was a lawyer, was required to withhold income tax when (1) paying their own court-approved professional fees from the bankruptcy estate, and (2) distributing dividends from the estate to the bankrupt company's former employees for their pre-bankruptcy retirement benefit claims. The Court drew a clear distinction between these two scenarios.

The Bankrupt Estate and Its Payouts: Withholding Dilemmas

The appellant, X, was a lawyer appointed as the bankruptcy trustee for Company A, which was declared bankrupt by the Osaka District Court on September 16, 1999. In the course of administering the bankruptcy estate under the old Bankruptcy Act, X made several key payments:

- Trustee's Fees: The Osaka District Court approved fees for X's services as trustee. X paid himself ¥30 million on July 3, 2000, and a further ¥50 million on March 28, 2001, both from the bankruptcy estate ("the subject fees").

- Dividends for Employee Retirement Benefits: On August 30, 2000, X distributed a total of approximately ¥594 million from the bankruptcy estate to 270 former employees of Company A. These payments were dividends on their unsecured claims for retirement benefits that had accrued prior to Company A's bankruptcy (the employees had all resigned as of the bankruptcy declaration date, September 16, 1999) ("the subject retirement benefit claims").

Subsequently, on October 23, 2003, the head of the Sumiyoshi Tax Office (Y) issued "notices of tax due" (納税の告知 - nōzei no kokuchi) and "non-payment additional tax assessments" (不納付加算税の賦課決定 - funōfu kasanzai no fuka kettei) to X. The tax office contended that X had an obligation to withhold income tax at source on both types of payments:

- For X's own trustee fees, under Article 204, paragraph 1, item 2 of the Income Tax Act (which applies to remuneration for services of lawyers, etc.).

- For the dividend payments to former employees, under Article 199 of the Income Tax Act (which applies to retirement allowances and similar payments).

The tax office also asserted that these withholding tax liabilities (and associated penalties) constituted "claims on the estate" (財団債権 - zaidan saiken), meaning they would have priority over general unsecured bankruptcy claims.

X challenged these tax office actions, primarily seeking a court declaration that no withholding tax obligation (and consequently no non-payment penalty) existed for either type of payment. In the alternative, X sought a declaration that if such tax liabilities did exist, they were not priority claims on the estate. The lower courts (Osaka District Court and Osaka High Court) had ruled against X on all substantive points, finding that X did have a withholding obligation for both his own fees and the retirement benefit distributions, and that these were priority claims on the estate. X appealed to the Supreme Court.

(The Supreme Court, before addressing the merits, noted ex officio a procedural development: X had filed a separate lawsuit to cancel the non-payment additional tax assessment specifically related to the August 2000 dividends for retirement benefits. The Osaka District Court had cancelled that particular penalty, and this part of that separate judgment had become final because the tax office did not appeal it further. Consequently, the Supreme Court dismissed the part of X's current appeal seeking confirmation of non-liability for that specific penalty, as X no longer had a legal interest in that particular point.)

The Legal Questions: Trustee's Role as "Payer" and Priority of Tax

The Supreme Court focused on two main legal questions regarding the bankruptcy trustee's withholding tax obligations under the old Bankruptcy Act regime:

- Does a bankruptcy trustee (who is a lawyer) have an income tax withholding obligation under Article 204, paragraph 1, item 2 of the Income Tax Act when paying their own court-approved professional fees from the bankruptcy estate? If so, is the resulting withholding tax liability a priority "claim on the estate"?

- Does a bankruptcy trustee have an income tax withholding obligation under Article 199 of the Income Tax Act when distributing dividends from the bankruptcy estate to former employees in satisfaction of their pre-bankruptcy claims for retirement benefits?

The Supreme Court's Differentiated Ruling

The Supreme Court delivered a differentiated judgment:

1. Trustee's Own Fees (Withholding Obligation Affirmed):

The Court upheld the lower courts' finding that X, as a lawyer acting as bankruptcy trustee, did have an obligation to withhold income tax on his own professional fees paid from the bankruptcy estate.

- Fees as Professional Remuneration: The fees received by a lawyer-trustee fall under the category of "remuneration for the services of a lawyer" as stipulated in Article 204, paragraph 1, item 2 of the Income Tax Act.

- "Payer" in Case of Self-Payment: The general rationale for imposing a withholding obligation (as established in the Supreme Court's Grand Bench judgment of February 28, 1962 – the Tsukigase case, which is case t113) is the "especially close relationship" (toku ni missetsu na kankei) between the payer and the recipient, which provides "special convenience and efficiency in tax collection." A bankruptcy trustee's fees are considered expenses for the administration, liquidation, and distribution of the bankruptcy estate (under Article 47, item 3 of the old Bankruptcy Act). The trustee, acting with exclusive management and disposition rights over the estate assets, pays these fees to themselves as compensation for their professional services. The Supreme Court reasoned that in this act of self-payment from the estate, the lawyer-trustee effectively functions as the "payer" (支払をする者 - shiharai o suru mono) within the meaning of Article 204, paragraph 1. Thus, the trustee is obligated to withhold income tax on their own fees at the time of such payment.

- Tax as a Priority Claim on the Estate: The withholding tax on the trustee's fees is considered a necessary administrative expense for the proper conduct of the bankruptcy proceedings, benefiting all creditors by ensuring the estate is managed. As such, it qualifies as a priority "claim on the estate" under the old Bankruptcy Act (specifically, Article 47, item 2 proviso, as "expenses incurred with respect to the bankruptcy estate"). The non-payment additional tax associated with this withholding tax was also deemed a priority claim on the estate (citing prior Supreme Court precedents from 1968 and 1987).

2. Dividends on Employee Retirement Benefit Claims (No Withholding Obligation Found):

In a crucial divergence from the lower courts, the Supreme Court held that the bankruptcy trustee (X) did not have an income tax withholding obligation under Article 199 of the Income Tax Act when distributing dividends from the bankruptcy estate to the former employees of Company A for their pre-bankruptcy retirement benefit claims.

- Trustee's Independent Status: A bankruptcy trustee is appointed to carry out bankruptcy proceedings fairly and equitably and acts in a position independent from the bankrupt entity itself. The trustee does not stand in a direct debtor-creditor relationship with the former employees regarding their pre-bankruptcy employment claims against the company.

- Absence of "Especially Close Relationship": The Court again referenced the "especially close relationship" principle from the 1962 Tsukigase case as the rationale for imposing withholding obligations. It found that when a bankruptcy trustee distributes dividends on pre-existing retirement claims, they are performing a statutory duty within the bankruptcy process. In this context, there is no "especially close relationship" between the trustee and the former employees that would be analogous to the direct employer-employee relationship that typically underpins the withholding obligation for retirement allowances.

- No Automatic Succession to Withholding Agent Status: While a bankruptcy trustee succeeds to the bankrupt company's rights to manage and dispose of the estate assets (under Article 7 of the old Bankruptcy Act), the Supreme Court found no legal basis to conclude that the trustee automatically succeeds to the bankrupt company's former status as a withholding agent specifically for pre-bankruptcy retirement benefit payments. The payment of dividends on these bankruptcy claims is distinct from the original payment of retirement benefits by an employer.

- Conclusion on Retirement Dividends: Therefore, the Supreme Court concluded that a bankruptcy trustee, when distributing dividends from the estate on pre-bankruptcy retirement benefit claims, is not included in the definition of a "payer" under Article 199 of the Income Tax Act. Consequently, the trustee has no obligation to withhold income tax on such dividend payments.

The Supreme Court thus quashed the part of the High Court's decision that had affirmed X's withholding obligation for the August 2000 retirement benefit dividends, and it entered a judgment confirming the non-existence of this specific tax liability for X. The parts of X's appeal concerning the withholding on his own fees were dismissed.

Analysis and Implications

This 2011 Supreme Court decision offers important clarifications on the extent of a bankruptcy trustee's income tax withholding duties under Japan's old Bankruptcy Act:

- "Especially Close Relationship" as a Decisive Criterion: The ruling prominently features the "especially close relationship" test, derived from the 1962 Tsukigase case, as a key factor in determining whether a withholding obligation arises. For a trustee paying their own professional fees from the estate they control, this relationship is deemed to exist due to the direct nature of the self-payment and control over the funds. However, for distributions to former employees on their pre-existing claims against the bankrupt company, the trustee is seen as an independent administrator fulfilling statutory duties, lacking the direct employer-like nexus with the recipients.

- Clarification for Bankruptcy Practice (Under Old Law): The decision resolved differing views in lower courts regarding a trustee's withholding duty for retirement benefit distributions in bankruptcy, establishing that no such duty existed under the old Bankruptcy Act. This was a significant point for bankruptcy practitioners.

- Relevance to Current Bankruptcy Law (and Potential Differences): It is important to note, as legal commentators have pointed out, that this case was decided under the old Bankruptcy Act. The current Bankruptcy Act (which fully replaced the old law in 2005) contains different provisions. For example, Article 148, paragraph 1, item (i) of the current Act gives priority status to claims for taxes "for which the cause arose against the bankruptcy estate," and Article 148, paragraph 4 deems claims arising from the trustee's actions in managing the estate (which could include tax obligations incurred by the trustee) as such claims on the estate. While the current Supreme Court case found no underlying withholding duty for retirement distributions under the old law, if such a duty were found to exist for some payment made by a trustee under the current law, its status as a priority claim on the estate might be analyzed differently based on these newer provisions.

Conclusion

The Supreme Court's 2011 judgment drew a critical distinction regarding a bankruptcy trustee's income tax withholding obligations under Japan's former bankruptcy regime. While a trustee who is a professional (like a lawyer) is obligated to withhold income tax on their own fees when paid from the bankruptcy estate (with this tax liability also being a priority claim on the estate), the Court found that the trustee did not have a similar withholding obligation when distributing dividends from the estate to a bankrupt company's former employees in satisfaction of their pre-bankruptcy retirement benefit claims. This latter conclusion was primarily based on the absence of the "especially close relationship" deemed necessary to characterize the trustee as a "payer" for such distributions under the Income Tax Act. The decision underscores the importance of the specific legal relationship between the disburser of funds and the recipient in determining the applicability of withholding tax duties, particularly in the complex context of bankruptcy administration.