Attaching a Doctor's Future Medical Service Fees for Support Obligations: A 2005 Japanese Supreme Court Ruling

Case Name: Appeal Against a Decision Dismissing an Execution Appeal Against a Decision Partially Dismissing an Application for a Claim Attachment Order

Court: Supreme Court of Japan, Third Petty Bench

Case Number: Heisei 17 (Kyo) No. 19

Date of Decision: December 6, 2005

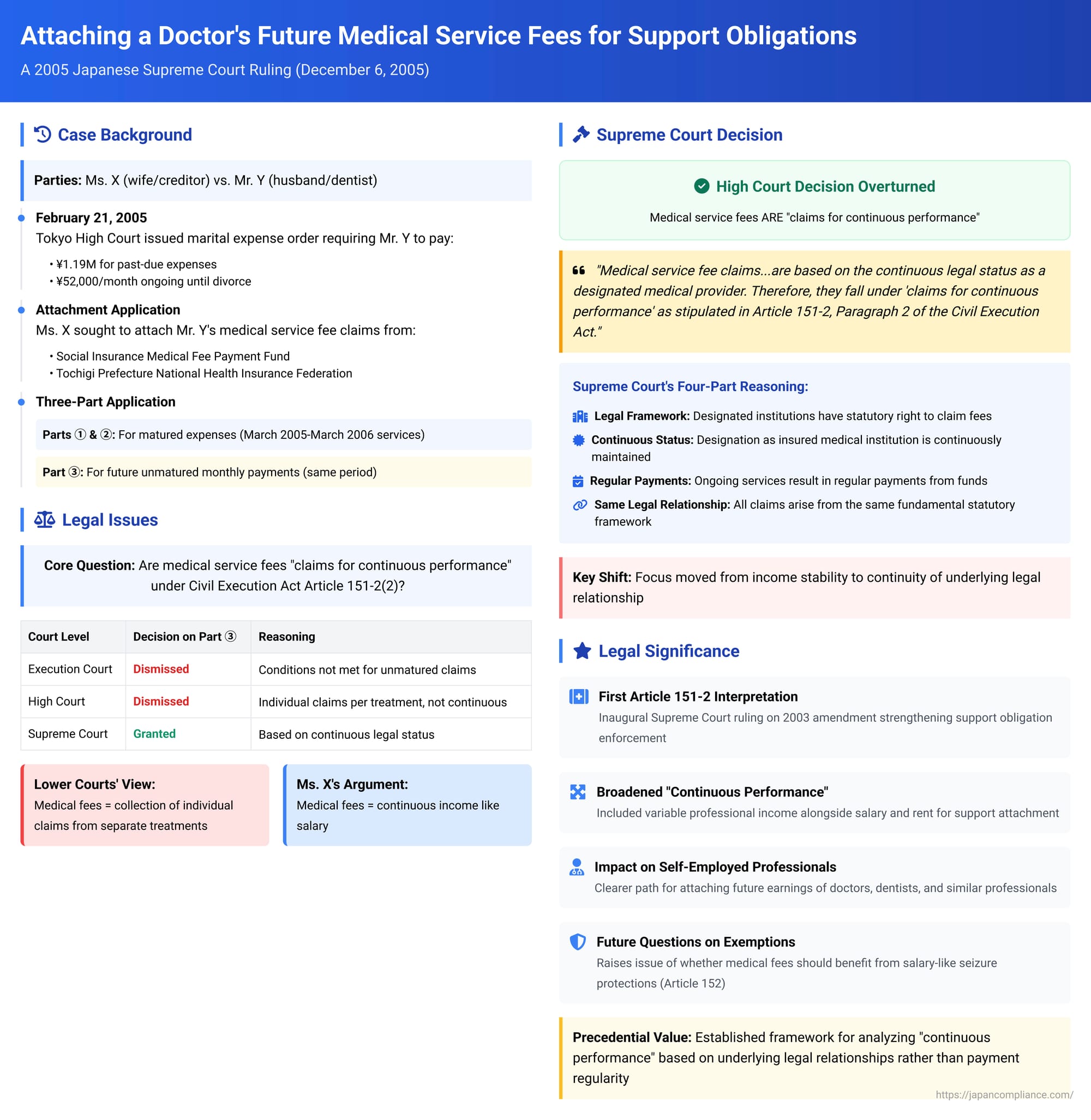

This article examines a significant Japanese Supreme Court decision from December 6, 2005. The ruling addresses whether a physician's future claims for medical service fees (shinryō hōshū saiken) payable by social insurance funds can be classified as "claims for continuous performance" (keizokuteki kyūfu ni kakaru saiken) under Article 151-2 of the Civil Execution Act. This classification is crucial for determining if such future income can be attached to satisfy ongoing periodic obligations, such as marital expense sharing. This was the first Supreme Court decision interpreting Article 151-2, which had been introduced by a 2003 amendment to the Act.

Factual Background: Marital Expenses and Attachment of Professional Income

The case originated from a marital dispute:

- Marital Expense Order: On February 21, 2005, the Tokyo High Court issued an order in a marital expense sharing (kon'in hiyō buntan) case between Ms. X (the wife/creditor, appellant in the Supreme Court) and Mr. Y (the husband/debtor, respondent, a practicing dentist). The order, which became final and binding, required Mr. Y to pay Ms. X:

- (1) Approximately JPY 1.19 million for past-due marital expenses up to the preceding month.

- (2) JPY 52,000 per month, payable by the end of each month, starting from that month until their divorce or the dissolution of their state of separation.

- Attachment Application: Using this court order as an enforceable title of obligation (saimu meigi), Ms. X applied to the execution court to attach Mr. Y's medical service fee claims. Mr. Y, as a dentist operating a clinic, received these fees from entities like the Social Insurance Medical Fee Payment Fund and the Tochigi Prefecture National Health Insurance Federation. Ms. X's attachment application comprised three parts:

- Part ① & ②: To satisfy the matured (past-due) portion of the marital expense order, Ms. X sought to attach Mr. Y's medical service fee claims due from the Social Insurance Medical Fee Payment Fund and the Tochigi Prefecture National Health Insurance Federation, respectively, for services rendered by Mr. Y between March 4, 2005, and March 3, 2006.

- Part ③: To satisfy the unmatured (future) monthly marital expense payments, Ms. X sought to attach Mr. Y's medical service fee claims due from the Social Insurance Medical Fee Payment Fund for services rendered during the same period (March 4, 2005, to March 3, 2006). This attachment was specifically for those medical fees that would become payable after the corresponding future marital expense installments themselves matured.

The Legal Question: Are Future Medical Service Fees "Claims for Continuous Performance"?

The core legal issue revolved around the interpretation of "claims for continuous performance" as used in Article 151-2, Paragraph 2 of the Civil Execution Act. This article, introduced in 2003, provides special rules for enforcing periodic monetary obligations arising from duties like support or marital expense sharing. Paragraph 1 allows for execution against future installments of such obligations if there has been any default. Paragraph 2 then specifies that such execution against future obligations can only target "salary or other claims for continuous performance" that fall due after the maturity of the respective future periodic payment.

The question was whether Mr. Y's future claims for medical service fees against the payment funds fit this definition.

Lower Courts' Negative View

- Execution Court (Utsunomiya District Court, Ashikaga Branch): The execution court granted Parts ① and ② of Ms. X's application (for matured marital expenses). However, it dismissed Part ③, which sought to attach future medical fees for unmatured marital expenses. The court reasoned that the conditions for commencing execution for unmatured claims were not met for this type of income.

- High Court (Tokyo High Court): Ms. X appealed the dismissal of Part ③. The High Court upheld the execution court's decision. It reasoned that medical service fee claims are essentially a collection of individual claims arising from specific medical treatments provided to different patients. Unlike salary or rental income, they do not stem from a single, continuous underlying legal relationship. Therefore, the High Court concluded, they do not qualify as "claims for continuous performance."

Ms. X appealed this decision to the Supreme Court, arguing that medical service fee claims are indeed "claims for continuous performance" and that the lower courts had erred in their interpretation of the law.

The Supreme Court's Landmark Decision

On December 6, 2005, the Supreme Court overturned the High Court's decision and the execution court's partial dismissal of Ms. X's application (Part ③). It remanded this part of the case back to the execution court for further proceedings consistent with its ruling.

The Supreme Court held:

"Medical service fee claims that a hospital or clinic, designated as an insured medical institution under legal provisions (e.g., Health Insurance Act Art. 63(3)(i), National Health Insurance Act Art. 36(3)), acquires against a payment fund (acting on behalf of insurers after reviewing medical service details) are based on the continuous legal status as a designated medical provider. Therefore, they fall under 'claims for continuous performance' as stipulated in Article 151-2, Paragraph 2 of the Civil Execution Act."

The Court's reasoning was as follows:

- Legal Framework for Medical Fees: Hospitals and clinics designated as insured medical institutions provide medical diagnosis and treatment to insured patients. Under various laws (e.g., Health Insurance Act, National Health Insurance Act, Social Insurance Medical Fee Payment Fund Act), these institutions acquire the right to claim medical service fees from payment funds, which are entrusted by insurers to handle these payments.

- Continuous Nature of the Right to Claim: The status of being able to claim these medical service fees arises from the legal designation as an insured medical institution. This status is, by its nature, continuously maintained.

- Regular Payments Based on Services: As a result of this ongoing designation and the provision of medical services, the designated hospital or clinic regularly receives payments from the fund corresponding to the services rendered. This also applies to payments made through the fund under other schemes like the Public Assistance Act or the Child Welfare Act.

- Conclusion: Therefore, the medical service fee claims acquired by such designated institutions against payment funds arise continuously from the same fundamental legal relationship. This relationship is grounded in the statutory framework of the social insurance system and the institution's ongoing designation within it. Consequently, these claims qualify as "claims for continuous performance."

Analysis and Significance

This 2005 Supreme Court decision was groundbreaking for several reasons:

- First Interpretation of Article 151-2: It was the first Supreme Court ruling to interpret the provisions of Article 151-2 of the Civil Execution Act, a then-recent amendment aimed at strengthening the enforcement of ongoing support obligations.

- Broadening "Claims for Continuous Performance": The decision significantly clarified the scope of "claims for continuous performance." By including a physician's future medical service fees, it recognized that such professional income, even if variable in amount, can be treated similarly to salary or rent for the specific purpose of securing future periodic support payments under Article 151-2.

- Shift in Focus from Income Stability to Legal Basis: Prior to this ruling, lower courts and academic opinions were divided on whether variable income like medical fees could be "continuous." Some focused on the lack of fixed monthly amounts (unlike salary) to deny their continuous nature. The Supreme Court, however, shifted the focus from the stability of the amount of income to the stability and continuity of the underlying legal relationship that generates the income—in this case, the doctor's ongoing status as a designated provider within the social insurance system.

- Implications for Enforcing Support Obligations: The ruling is particularly important for enforcing support obligations (like alimony, child support, or marital expenses) against self-employed professionals whose income is not a fixed salary. It provides a clearer path for attaching their future professional earnings.

- Potential for New Questions (Seizure Exemptions): The commentary surrounding this case notes an important implication: if medical service fees are to be treated like "salary or other claims for continuous performance," a question arises as to whether they should also benefit from the partial seizure exemptions provided for salary under Article 152 of the Civil Execution Act. These exemptions are designed to protect a debtor's livelihood. The Supreme Court's decision did not address this issue, but it logically follows that if such income is attachable like salary for satisfying support debts, its role as the debtor's means of subsistence might also warrant similar protective measures. Ensuring the debtor-physician can maintain their practice is also in the long-term interest of the creditor relying on that future income.

Conclusion

The Supreme Court's December 6, 2005, decision significantly expanded the practical reach of Article 151-2 of the Civil Execution Act by classifying a dentist's future medical service fee claims as "claims for continuous performance." This allows for the attachment of such future income to satisfy ongoing marital expense obligations (and by extension, other similar support duties). The ruling's emphasis on the continuity of the underlying legal framework, rather than the precise regularity of income amounts, provides a more flexible and realistic approach to enforcing support against professionals with variable income streams. It also opens the door to further discussions about the application of protective measures, like seizure exemptions, to such professional earnings.