Antitrust Oversight in Japanese M&A: Understanding Merger Control and the Role of Monitoring Trustees

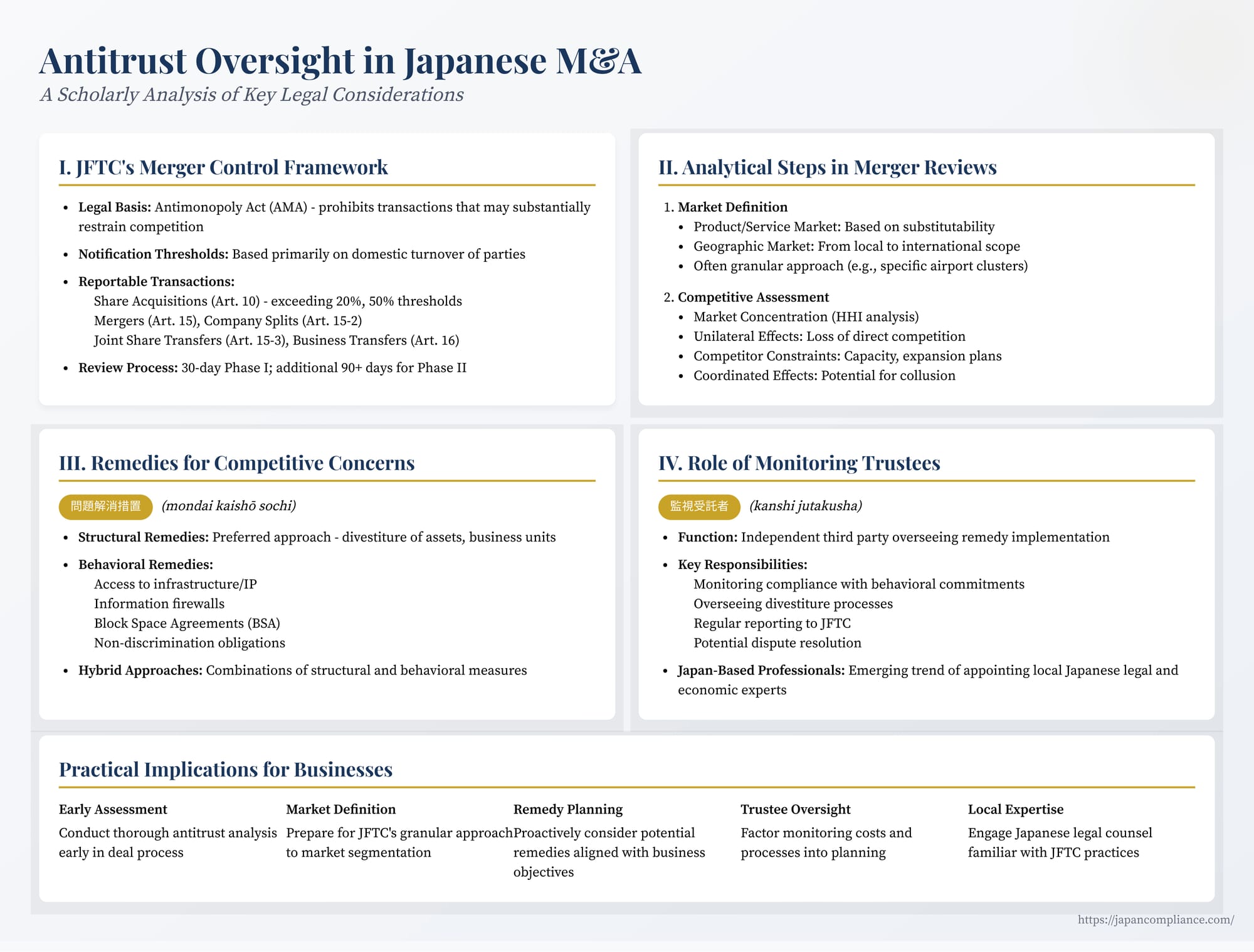

TL;DR: Japan’s Antimonopoly Act requires pre-merger filings when thresholds are met, and the JFTC rigorously analyses unilateral and coordinated effects. Where concerns arise, structural or behavioural remedies—often overseen by monitoring trustees—enable clearance. Early antitrust assessment and local expertise are critical for deal certainty.

Table of Contents

- Japan’s Merger Control Framework: The Basics

- Key Analytical Steps in JFTC Merger Reviews

- Remedies: Addressing Competitive Concerns

- The Role of Monitoring Trustees in Japan

- Practical Implications for Businesses in M&A Deals

- Conclusion: Navigating Japan's Merger Control Landscape

As cross-border mergers and acquisitions continue to shape the global business landscape, understanding the intricacies of antitrust oversight in key jurisdictions like Japan is paramount. The Japan Fair Trade Commission (JFTC), enforcing the Act on Prohibition of Private Monopolization and Maintenance of Fair Trade (commonly known as the Antimonopoly Act or AMA), plays a crucial role in reviewing transactions that could impact competition within Japanese markets. For international companies involved in M&A with a Japanese nexus, navigating the JFTC's merger control process requires careful planning and strategic insight. This is particularly true for complex deals where potential competitive concerns necessitate remedies, increasingly involving the appointment of monitoring trustees – often drawn from Japan's own pool of legal and economic experts – to ensure compliance.

Japan's Merger Control Framework: The Basics

The JFTC's authority to review mergers stems primarily from the AMA, which prohibits transactions that may substantially restrain competition in a particular field of trade. The review process is typically triggered by mandatory pre-merger notifications based on specific thresholds, mainly concerning the domestic turnover of the parties involved. Key types of transactions subject to notification include:

- Share Acquisitions (Art. 10): Acquiring voting rights exceeding certain thresholds (e.g., 20%, 50%) in a Japanese company, where the acquiring group and the target group meet specific domestic turnover thresholds.

- Mergers (Art. 15), Company Splits (Art. 15-2), Joint Share Transfers (Art. 15-3), Business Transfers (Art. 16): These structural transactions are also subject to notification if the relevant parties exceed domestic turnover thresholds.

(Note: Turnover thresholds are subject to change; as of recent information, key thresholds often involved one party having over JPY 20 billion and another having over JPY 5 billion in domestic turnover, but specific thresholds vary by transaction type and require careful verification at the time of the deal).

Once a notification is filed, the JFTC typically conducts a Phase I review, usually within 30 days. If no concerns are raised, the transaction is cleared. However, if potential issues are identified, the JFTC may open a Phase II review, requesting detailed information and conducting a more in-depth analysis, which can extend the review period significantly (often by an additional 90 days or more).

The substantive test applied by the JFTC is whether the proposed transaction "may substantially restrain competition in any particular field of trade" (kyōsō no jisshitsuteki seigen - 競争の実質的制限). This involves a comprehensive assessment of the potential impact on the relevant market(s).

Key Analytical Steps in JFTC Merger Reviews

The JFTC's analysis follows a structured approach, outlined in its Merger Guidelines. Understanding these steps is crucial for predicting potential concerns and engaging effectively with the agency. A recent JFTC review of a major merger in the international air cargo sector provides a useful illustration of this process (JFTC Clearance, Jan 30, 2025).

1. Market Definition:

This is the foundational step, defining the boundaries of competition. It involves identifying:

- Product/Service Market: Determining the scope of products or services that are reasonably interchangeable from the perspective of customers (demand-side substitutability) and, sometimes, suppliers (supply-side substitutability). In the air cargo case, the JFTC distinguished core air cargo transport from services offered by integrators (generally) and maritime transport, treating the latter as adjacent markets. Crucially, it also segmented the market based on the type of aircraft used – dedicated freighters capable of carrying large or dangerous goods versus cargo carried in the belly of passenger aircraft. This led to the definition of two overlapping relevant markets: an "overall cargo market" and a more specific "large/dangerous goods market," acknowledging different competitive dynamics within each.

- Geographic Market: Defining the geographic area within which competition takes place. This can range from local to national or international. For international services like air cargo, the JFTC focused on specific origin-destination pairs. Based on the logistics networks of freight forwarders (key customers), the geographic scope for routes originating in Japan bound for the US was defined not as the entire US, but as specific airport clusters, such as "around Los Angeles" and "around Chicago". This granular approach reflects the JFTC's focus on the practical realities of competition.

2. Competitive Assessment:

Once the market is defined, the JFTC assesses the likely competitive effects of the merger. This involves analyzing:

- Market Concentration: Calculating market shares of the merging parties and competitors, and assessing concentration levels, often using the Herfindahl-Hirschman Index (HHI). While high shares raise concerns, the JFTC looks beyond simple numbers.

- Unilateral Effects: Assessing whether the merged entity would gain the ability and incentive to unilaterally raise prices, reduce output, lower quality, or hinder innovation. This involves considering:

- Loss of Direct Competition: How closely did the merging parties compete pre-merger?

- Competitor Constraints: How effectively can remaining competitors discipline the merged entity? This was a key factor in the air cargo case. Even with post-merger shares in the 30-35% range, the JFTC found a substantial restraint likely because competitors faced significant capacity constraints. Factors like market congestion (particularly on trans-Pacific routes involving transit cargo from China), lack of concrete expansion plans by rivals, and even strategic alliances between competitors and one of the merging parties were seen as limiting the competitive pressure competitors could exert.

- Buyer Power: Can powerful customers counteract potential price increases?

- Entry Barriers: How easy is it for new players to enter the market and challenge the merged firm?

- Coordinated Effects: Assessing whether the merger increases the likelihood of explicit or tacit collusion among the remaining players in the market. This involves analyzing market transparency, product homogeneity, symmetry between competitors, and the existence of coordinating mechanisms. (This was considered but not found to be a primary concern in the illustrative air cargo case).

Remedies: Addressing Competitive Concerns

If the JFTC concludes that a merger is likely to substantially restrain competition, it doesn't necessarily block the deal outright. Instead, it often engages with the parties to find remedies (referred to as "problem-solving measures" - mondai kaishō sochi - 問題解消措置) that adequately address the identified concerns. Approval is then conditioned upon the implementation of these remedies.

Remedies can be broadly categorized as:

- Structural Remedies: These involve changes to the market structure, most commonly divestitures – the sale of assets, business units, or subsidiaries to a suitable buyer approved by the JFTC. This is often the JFTC's preferred approach, particularly for horizontal mergers, as it directly addresses the concentration issue and typically requires less ongoing monitoring.

- Behavioral Remedies: These involve commitments regarding the future conduct of the merged entity. Examples include:

- Granting access to essential infrastructure or IP to competitors.

- Establishing information firewalls to prevent sensitive data sharing between different business units.

- Non-discrimination obligations.

- Specific contractual commitments, such as guaranteeing supply to certain customers or, as in the air cargo case, entering into a Block Space Agreement (BSA) to make capacity available to a competitor, thereby mitigating the impact of consolidation on market capacity.

- Hybrid Remedies: Combinations of structural and behavioral measures.

The JFTC evaluates proposed remedies based on their effectiveness, viability, and monitorability. While structural remedies are often favored for their clean break, complex behavioral remedies are accepted when they are deemed sufficient and practical to implement and monitor.

The Role of Monitoring Trustees in Japan

For complex remedies, especially behavioral ones or intricate divestitures requiring careful execution over time, the JFTC increasingly relies on Monitoring Trustees (kanshi jutakusha - 監視受託者). A monitoring trustee is an independent third party, approved by the JFTC and typically paid by the merging parties, whose primary function is to oversee the implementation of the agreed-upon remedies and report on compliance to the JFTC.

The trustee's role can encompass various tasks, depending on the nature of the remedies:

- Monitoring Compliance: Verifying that the merged company adheres to its behavioral commitments (e.g., honoring access agreements, maintaining firewalls, fulfilling BSA obligations).

- Overseeing Divestitures: Ensuring the timely sale of divestment packages to suitable purchasers under the agreed terms.

- Reporting: Providing regular, objective reports to the JFTC on the progress and effectiveness of the remedies.

- Dispute Resolution: Potentially acting as a first point of contact or mediator for disputes arising between the merged entity and third parties concerning the remedies.

A notable trend, highlighted in the commentary surrounding the recent air cargo merger remedy, is the JFTC's appointment of Japan-based professionals – typically lawyers and economists from established Japanese firms or consultancies – as monitoring trustees, even in significant international transactions. While global consulting or law firms are often appointed in other major jurisdictions, the selection of local experts in Japan suggests a developing capacity and preference for leveraging domestic expertise. This may reflect advantages in terms of local market knowledge, language proficiency, and potentially smoother coordination with the JFTC staff. The appointment of specific Japanese law and economic consulting firms in the air cargo case exemplifies this trend.

The use of monitoring trustees adds a layer of independent oversight, providing the JFTC with greater assurance that remedies will be effectively implemented and maintained, ultimately ensuring that the competitive integrity of the market is preserved post-merger.

Practical Implications for Businesses in M&A Deals

For companies contemplating M&A transactions with a potential impact on Japanese markets, several practical considerations arise from the JFTC's robust oversight framework:

- Early Antitrust Assessment: Conduct thorough antitrust analysis early in the deal process to identify potential JFTC concerns, considering market shares, competitive overlaps, and potential constraints on competitors.

- Sophisticated Market Definition: Be prepared to engage with the JFTC on market definition, recognizing its potentially granular approach based on product characteristics, supply-side factors, and geographic realities.

- Prepare for Remedy Discussions: If competitive concerns are likely, proactively consider potential remedies (both structural and behavioral) that could effectively address the issues while aligning with business objectives.

- Anticipate Monitoring: In complex cases requiring non-standard or behavioral remedies, anticipate the potential requirement for a monitoring trustee and factor the associated costs and oversight processes into planning.

- Engage Local Expertise: Utilize experienced Japanese legal counsel and economic consultants familiar with the JFTC's specific practices, guidelines, and analytical approaches. Their local knowledge is invaluable in navigating the review process and negotiating effective remedies, including potentially interfacing with locally appointed trustees.

Conclusion: Navigating Japan's Merger Control Landscape

Japan's merger control regime, enforced by the JFTC under the Antimonopoly Act, is a critical consideration for any significant M&A activity affecting its markets. The JFTC employs a rigorous analytical framework, focusing on whether a transaction may substantially restrain competition, paying close attention to market definition and the actual competitive dynamics, including competitor capacity. Where concerns arise, the JFTC demonstrates a willingness to accept remedies, but increasingly relies on mechanisms like monitoring trustees – often leveraging local Japanese expertise – to ensure these solutions are effective, particularly in complex or international deals. For businesses navigating this landscape, proactive engagement, strategic planning, thorough analysis, and collaboration with knowledgeable local advisors are essential for achieving successful transaction outcomes while satisfying regulatory requirements.

- Platform Power and Antitrust in Japan: Lessons from an Algorithm Change Case

- When Antitrust Violations Hit Home: Director Liability for JFTC Surcharges in Japan

- Antitrust Green Lights? Navigating Sustainability Collaborations in Japan

- JFTC — Merger Review Guidelines (English digest)

https://www.jftc.go.jp/en/pressreleases/yearly-2023/December/2023_guidelines_merger.html