Sustainability Collaborations in Japan: JFTC “Green Guidelines” & Antitrust Safe Paths

TL;DR

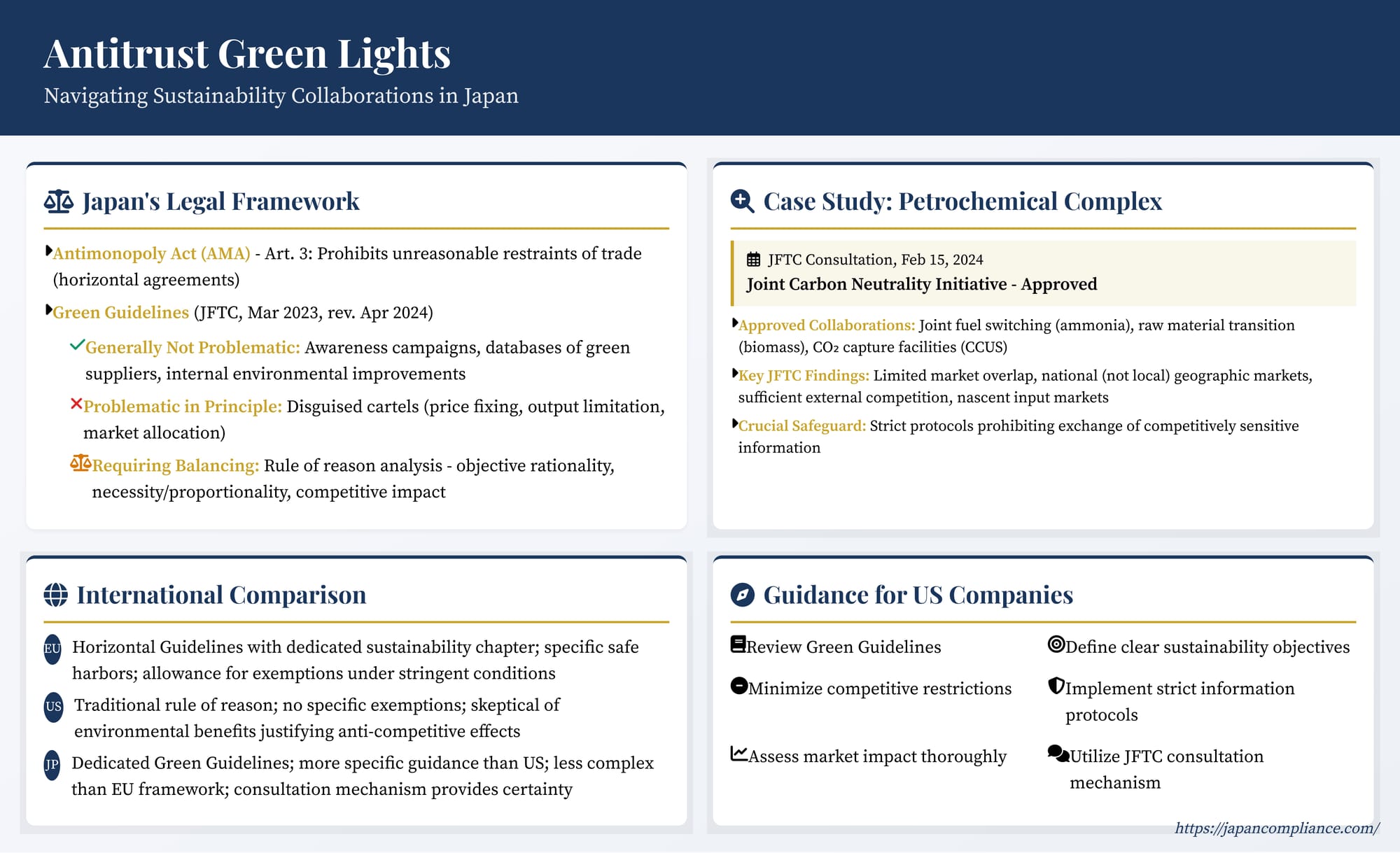

- Japan’s JFTC “Green Guidelines” outline when competitor collaboration for decarbonisation is clearly lawful, problematic in principle, or needs a rule-of-reason balance.

- A February 2024 petrochemical-complex consultation shows the JFTC will green-light joint infrastructure, R&D and even joint purchasing if market power is limited.

- US firms should structure projects around clear objectives, indispensability, strict information firewalls and—when in doubt—seek JFTC pre-consultation.

Table of Contents

- Japan's Framework: The Antimonopoly Act and the Green Guidelines

- Case Study: Carbon Neutrality in a Petrochemical Complex (JFTC Consultation, Feb 15 2024)

- Analysis and Key Takeaways from the Case

- Brief International Comparison

- Guidance for US Companies Collaborating in Japan

- Conclusion

The global push towards environmental sustainability, driven by climate change concerns, resource scarcity, and evolving societal expectations, presents both challenges and opportunities for businesses worldwide. Achieving ambitious goals like carbon neutrality or establishing circular economies often requires significant investment, innovation, and coordinated action across industries. This frequently necessitates collaboration among companies, including direct competitors.

However, such collaborations immediately raise red flags under antitrust and competition laws globally. Agreements between competitors regarding production methods, input sourcing, product standards, or even joint research and development can easily spill over into anti-competitive coordination, potentially harming consumers through higher prices, reduced output, or stifled innovation. How can businesses pursue legitimate and necessary sustainability goals collaboratively without violating competition rules?

Japan has been proactive in addressing this tension. Recognizing the need for clarity to encourage beneficial environmental initiatives, the Japan Fair Trade Commission (JFTC) has issued specific guidance and actively engages with businesses through consultations. Understanding Japan's framework under the Antimonopoly Act (AMA) is crucial for any company, including US firms, contemplating sustainability-focused collaborations involving Japanese partners or markets.

Japan's Framework: The Antimonopoly Act and the Green Guidelines

The primary Japanese competition law is the Act on Prohibition of Private Monopolization and Maintenance of Fair Trade (commonly known as the Antimonopoly Act or AMA). Article 3 of the AMA prohibits unreasonable restraints of trade, which typically covers anti-competitive agreements between competitors (horizontal agreements or cartels).

To provide specific clarity in the context of environmental sustainability, the JFTC published its "Guidelines Concerning the Activities of Enterprises, etc., Toward the Realization of a Green Society Under the Antimonopoly Act" (initially released in March 2023 and revised in April 2024), commonly referred to as the "Green Guidelines." These guidelines aim to foster activities contributing to a green society by clarifying the JFTC's interpretation of the AMA concerning collaborations pursuing environmental objectives.

The Green Guidelines establish an analytical framework based on the likely competitive effects of a collaboration:

- Agreements Generally Not Problematic: Collaborations that are unlikely to impede competition are generally permissible. Examples include:

- Creating general awareness campaigns about environmental issues.

- Establishing databases of sustainable suppliers or technologies without restricting participants' choices.

- Joint efforts solely focused on improving internal corporate environmental performance without impacting market behavior (e.g., reducing office energy consumption).

- Collaborations where participants collectively have a very low market share or where sufficient competitive pressure exists from non-participants.

- Agreements Problematic in Principle: Agreements that are essentially anti-competitive conduct disguised as sustainability initiatives (sham arrangements) remain prohibited. This includes classic cartel behavior like price fixing, output limitation, market allocation, or bid rigging, even if claimed to be necessary for environmental goals.

- Agreements Requiring Balancing (Rule of Reason Approach): Collaborations that may have both potential anti-competitive effects and pro-competitive benefits (including contributing to sustainability) require a more detailed analysis. The JFTC assesses these based on:

- Rationality of the Objective: Is the stated sustainability goal genuine, legitimate, and clearly defined?

- Necessity and Proportionality of the Means: Is the collaboration reasonably necessary to achieve the sustainability objective? Could the goal be reached through less anti-competitive means? Are the restrictions on competition indispensable and proportionate to the expected benefits?

- Overall Competitive Impact: A comprehensive balancing of the likely negative effects on competition (e.g., increased prices, reduced output, lower quality/variety, stifled innovation) against the likely pro-competitive effects. Importantly, the JFTC explicitly recognizes that benefits contributing to the realization of a green society (e.g., development of environmentally superior products, reduction of GHG emissions benefiting consumers) can be considered as pro-competitive effects in this balancing exercise.

This framework provides businesses with a structured way to assess the potential antitrust implications of their joint sustainability initiatives under Japanese law.

Case Study: Carbon Neutrality in a Petrochemical Complex (JFTC Consultation, Feb 15, 2024)

A significant example illustrating the JFTC's application of the Green Guidelines emerged from a formal consultation finalized in February 2024. Several companies operating within a specific petrochemical complex in Japan sought the JFTC's view on proposed joint activities aimed at achieving carbon neutrality for the complex by 2050. The participants included companies involved in various stages of petrochemical production, some competing in specific product markets, others operating at different levels of the value chain.

The Proposed Collaborations

The companies proposed a suite of ambitious joint initiatives:

- Fuel Switching for Power Generation: Jointly installing and utilizing power generation facilities designed to use ammonia (a potentially carbon-free fuel) instead of fossil fuels. This included joint R&D, construction, operation, and potentially joint procurement of ammonia fuel.

- Raw Material Transition: Shifting production inputs from traditional fossil fuel-based feedstocks to lower-emission alternatives like biomass. This involved plans for joint procurement of biomass and potential joint production of bio-based basic chemicals.

- CO2 Capture and Utilization/Storage (CCUS): Jointly developing and operating facilities to capture CO2 emissions generated during production processes, with plans for subsequent reuse (e.g., as a chemical feedstock) or storage.

- Information Exchange: Sharing technical and operational information necessary to facilitate these joint activities, but explicitly excluding competitively sensitive information such as individual company product prices, production volumes, or marketing strategies.

- Joint Equipment Disposal: Potentially coordinating the decommissioning or disposal of existing fossil-fuel-based infrastructure.

The JFTC's Assessment and Clearance

After reviewing the proposed plans, the JFTC concluded that these joint activities were unlikely to substantially restrain competition in any relevant market and were therefore not problematic under the AMA. Its reasoning addressed potential concerns in both output (product) and input (fuel/raw material) markets:

- Legitimate Objective: The overarching goal of achieving carbon neutrality within the industrial complex was recognized as a legitimate sustainability objective aligned with Japan's national goals and the principles of the Green Guidelines.

- Output Market Effects (Products):

- Limited Overlap: For many petrochemical products manufactured within the complex, the participating companies did not directly compete with each other.

- Broad Geographic Market: For products where competition did exist among participants, the JFTC determined the relevant geographic market was Japan-wide, not just the local complex area.

- Sufficient External Competition: In these national markets, numerous other strong competitors existed, and significant buyer power from large industrial customers also served as a competitive constraint.

- Conclusion: While the joint initiatives (particularly those impacting energy costs via fuel switching) could influence production costs, these cost effects were deemed unlikely to translate into a substantial lessening of competition at the national level, given the external competitive pressures.

- Input Market Effects (Fuel/Raw Materials):

- Joint Purchasing Concerns: The plans involved joint purchasing of ammonia (fuel) and biomass (feedstock), which can potentially restrict competition among buyers and depress supplier prices or foreclose rival buyers.

- Mitigating Factors: The JFTC considered these risks to be low in this specific context because:

- Nascent/Growing Markets: The markets for green ammonia as fuel and sustainable biomass feedstocks for chemical production were considered nascent but expected to grow significantly on a global scale due to decarbonization trends.

- Limited Volume: The anticipated volume to be jointly purchased by the complex participants was considered likely to be small relative to the expected total global supply in these emerging markets.

- Conclusion: The potential anti-competitive effects of joint purchasing in these specific input markets were deemed unlikely to be substantial.

Based on this analysis across relevant markets, the JFTC gave its clearance to the proposed collaborations.

Analysis and Key Takeaways from the Case

This petrochemical complex consultation provides valuable insights into the JFTC's practical application of the Green Guidelines:

- Support for Infrastructure Collaboration: It signals the JFTC's willingness to permit significant joint investments in shared infrastructure (like new power plants or CCUS facilities) deemed necessary for achieving ambitious, capital-intensive sustainability goals.

- Permissibility of Ancillary Joint Procurement: The clearance extended to joint procurement of novel inputs (ammonia fuel, biomass feedstock) directly linked to the operation of the joint infrastructure or transition process, provided the impact on the input market is not substantial.

- Importance of Market Definition: The finding of a national relevant market for competing products was crucial in concluding that local collaboration wouldn't harm overall competition. Collaborations confined to specific regions or product niches with fewer external competitors might face stricter scrutiny.

- Consideration of Future Market Dynamics: The JFTC considered the expected future growth and competitiveness of the relevant input markets (ammonia, biomass) when assessing the impact of joint purchasing, suggesting a dynamic rather than purely static analysis.

- Information Exchange Safeguards: While not detailed in the public summary, the explicit exclusion of price and output information from the proposed exchanges was likely a critical factor in the clearance. Robust information protocols are essential.

- Limitations of Published Information: The public summary lacks detailed quantitative data (market shares, cost impact analysis, projected purchase volumes vs. market size) that likely informed the JFTC's internal assessment. This limits its direct applicability as a precise template for other cases, emphasizing the value of the JFTC's consultation process for specific plans.

Brief International Comparison

The JFTC's approach can be contrasted with those in other major jurisdictions:

- European Union: The EU's revised Horizontal Block Exemption Regulations and Horizontal Guidelines (2023) include a dedicated chapter on sustainability agreements. It provides specific safe harbors (e.g., for sustainability standards) and allows for individual exemption under Article 101(3) TFEU if stringent conditions are met. These conditions require demonstrating indispensable restrictions, efficiency gains (which can include environmental benefits), a fair share of benefits passed on to consumers within the relevant market, and no elimination of substantial competition. The assessment of benefits accruing outside the relevant market or to future generations remains complex but is acknowledged more explicitly than in the past.

- United States: US antitrust agencies (DOJ and FTC) evaluate sustainability collaborations under the traditional rule of reason framework. There are no specific block exemptions or safe harbors for environmental collaborations. While agencies acknowledge that sustainability efforts can have pro-competitive justifications (e.g., developing new green technologies, meeting consumer demand for sustainable products), they have generally been skeptical of arguments that environmental benefits should excuse otherwise anti-competitive conduct that harms consumers through higher prices or reduced output/innovation. The focus remains firmly on the impact on the competitive process and consumer welfare within defined antitrust markets.

Japan's approach, with its dedicated Green Guidelines and consultation mechanism, arguably offers more specific upfront guidance than the US system, while perhaps being less doctrinally complex (though potentially less certain in outcome) than the EU's exemption framework regarding the quantification and pass-on of out-of-market benefits.

Guidance for US Companies Collaborating in Japan

For US companies considering joint sustainability initiatives with Japanese partners or impacting the Japanese market:

- Review the Green Guidelines: Understand the JFTC's analytical framework, examples of potentially problematic and non-problematic conduct, and the factors considered in the balancing test.

- Clearly Define Objectives and Necessity: Articulate the specific sustainability goals and demonstrate why collaboration is reasonably necessary to achieve them (e.g., due to scale, cost, technical complexity, risk sharing).

- Minimize Competitive Restrictions: Structure the collaboration to limit restraints on competition to what is indispensable for achieving the sustainability objective. Consider and document less restrictive alternatives.

- Implement Strict Information Protocols: Establish clear firewalls and protocols to prevent the exchange of competitively sensitive information, particularly regarding individual company pricing, output levels, costs (beyond those directly related to the joint project), and future strategic plans.

- Assess Market Impact: Analyze the potential effects on competition in all relevant output and input markets. Consider the market shares of participants and non-participants, the potential for market foreclosure, and the impact on prices, innovation, and consumer choice.

- Utilize JFTC Consultation: For collaborations that raise potential AMA concerns, especially those involving significant market players or substantial competitive restrictions, consider using the JFTC's formal or informal prior consultation system to obtain guidance and legal certainty before implementation.

Conclusion

The imperative to address environmental sustainability is driving unprecedented levels of potential collaboration among businesses, including competitors. Japan's JFTC has recognized this need and provided a framework through its Green Guidelines to help companies navigate the intersection of sustainability goals and Antimonopoly Act compliance. The clearance of the ambitious joint initiatives within the petrochemical complex demonstrates a pragmatic approach, allowing significant collaboration where competition is unlikely to be substantially restrained. However, the analysis remains highly fact-specific, and robust safeguards, particularly around information exchange, are critical. US companies engaging in green collaborations in Japan should leverage the JFTC's guidance and consultation mechanisms to ensure their beneficial environmental efforts do not inadvertently fall foul of competition law.

- Mandatory Sustainability Reporting in Japan: FIEA Rules & ISSB Alignment for Global Companies

- EU Data Act Compliance for US Firms with Japanese Links: Key Risks & Strategic Steps

- Antitrust Enforcement in Japan’s Energy Sector: JFTC Lessons from Cartel & Collusion Cases

- JFTC Green Guidelines – 2024 Revised Edition (PDF)

- JFTC Press Release: Revised Green Guidelines (24 Apr 2024)