Antitrust Enforcement in Japan's Liberalized Energy Markets: Lessons from Recent Cartel and Collusion Cases

TL;DR

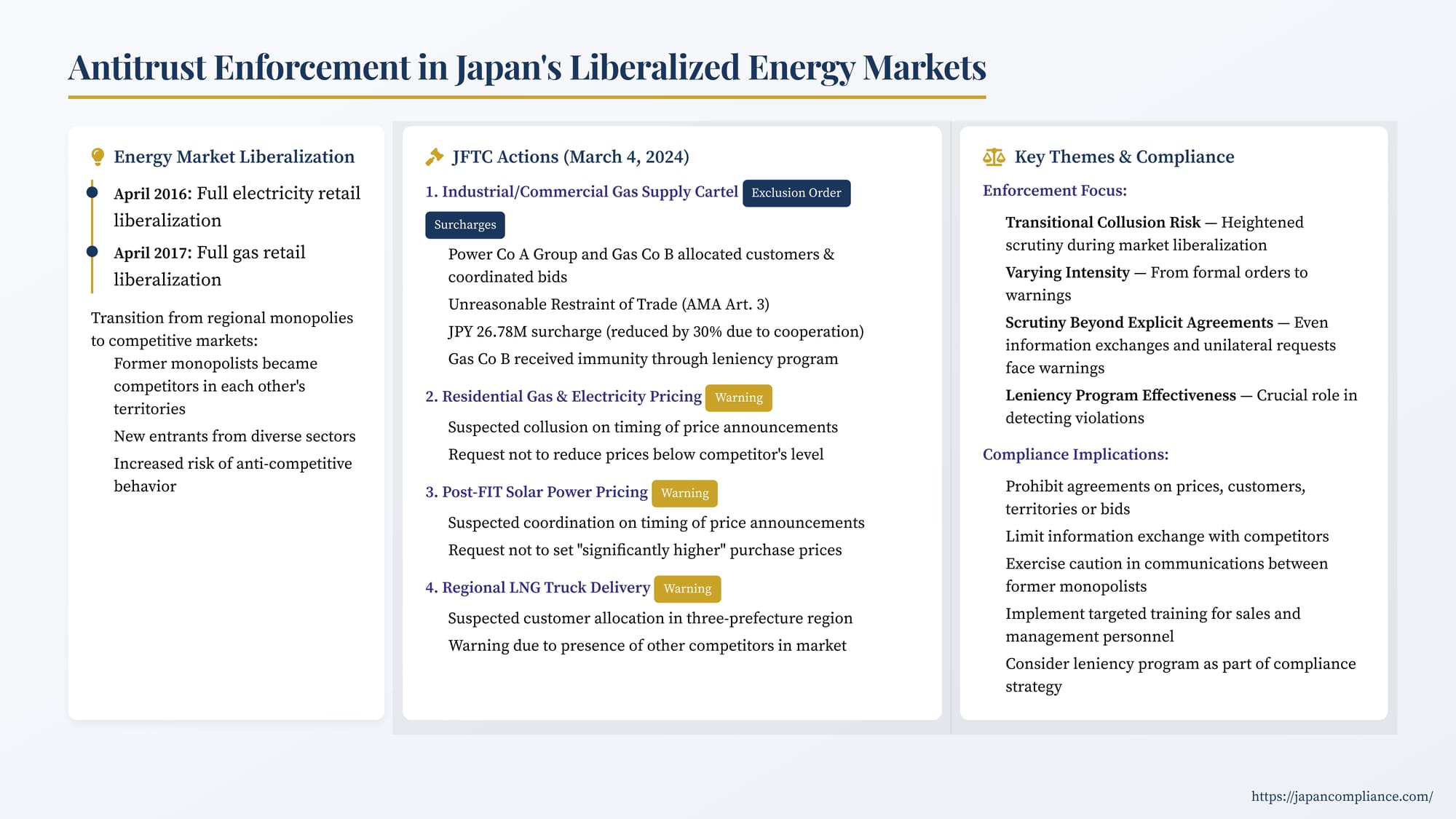

- Liberalization of Japan’s electricity (2016) and gas (2017) markets triggered a wave of JFTC scrutiny.

- A March 4 2024 case set formal orders and fines for a power–gas cartel, while three related warnings show that “soft” coordination also risks enforcement.

- Companies must tighten compliance: forbid customer allocation and information-sharing, train sales teams, and leverage leniency early.

Table of Contents

- Introduction: Competition Challenges in a New Energy Era

- Background: Energy Market Liberalization in Japan

- Case Study: JFTC Scrutinizes Power-Gas Company Interactions (Actions Announced March 4 2024)

- Key Themes and Compliance Implications

- Conclusion: Navigating Competition in Japan’s New Energy Landscape

Introduction: Competition Challenges in a New Energy Era

Japan's energy sector has undergone a significant transformation over the past decade. The full liberalization of the electricity retail market in 2016, followed by the gas retail market in 2017, dismantled long-standing regional monopolies and aimed to foster competition, innovation, and consumer choice. This deregulation opened the door for new players to enter the market, including established regional power companies expanding into gas supply and vice versa, alongside independent energy retailers.

However, transitioning from a regulated monopoly to a competitive market often presents unique challenges for antitrust enforcement. Incumbent players may be tempted to coordinate their actions with new entrants—especially other large incumbents venturing into their territory—to maintain market stability, protect traditional profit margins, or avoid aggressive price wars, rather than engaging in the vigorous competition envisioned by liberalization policies.

Recognizing these risks, the Japan Fair Trade Commission (JFTC), the country's primary competition authority, has been actively monitoring Japan's energy markets. A series of actions announced by the JFTC on March 4, 2024, involving suspected collusion between a major regional electric power group and the corresponding dominant regional gas utility, provide crucial insights into the types of conduct attracting scrutiny and the JFTC's enforcement approach in these critical, newly competitive sectors. For any company operating in, supplying to, or considering entry into Japan's energy markets, understanding these lessons is vital for navigating antitrust risks.

Background: Energy Market Liberalization in Japan

Prior to liberalization, Japan's electricity and gas markets were dominated by regional monopolies. Ten vertically integrated power companies served distinct geographic areas, handling generation, transmission, distribution, and retail. Similarly, large regional gas companies held monopolies over gas distribution and retail within their service territories.

The liberalization process, phased in over several years, aimed to introduce competition primarily at the retail level:

- Electricity: Fully liberalized in April 2016, allowing consumers (including residential) to choose their electricity supplier freely. This spurred market entry by gas companies, telecommunications firms, and others.

- Gas: Fully liberalized in April 2017, allowing consumers (including residential) to choose their city gas supplier. This encouraged power companies and others to enter the gas retail market.

This created a dynamic where former monopolists often became direct competitors in each other's traditional territories and core businesses (electricity vs. gas).

Case Study: JFTC Scrutinizes Power-Gas Company Interactions (Actions Announced March 4, 2024)

The JFTC's announcement on March 4, 2024, detailed several distinct enforcement actions and investigations related to interactions between a major regional power company group ("Power Co A Group," including its retail arm) and the incumbent regional gas utility ("Gas Co B") operating largely within the same geographic area. These actions spanned different market segments and resulted in varying levels of JFTC intervention, from formal orders to warnings.

Action 1: Industrial/Commercial Gas Supply Cartel (Exclusion & Surcharge Orders)

- The Finding: The JFTC issued a formal cease-and-desist order (排除措置命令, haijo sochi meirei) and a surcharge payment order (課徴金納付命令, kachōkin nōfu meirei – an administrative fine) against the retail arm of Power Co A Group. The JFTC found that Power Co A (and later its retail arm) and Gas Co B had entered into an agreement, from at least November 2016 onwards, to allocate customers and coordinate bids for large-volume city gas supply contracts solicited by specific industrial and commercial users (covering 23 identified supply points) located within Gas Co B's traditional service territory.

- The Violation: This conduct was deemed a cartel agreement constituting an Unreasonable Restraint of Trade, violating Article 3 of the Antimonopoly Act (AMA). This type of explicit collusion – agreeing not to compete for specific customers or coordinating bids – is considered a "hardcore" antitrust violation.

- The Outcome:

- Power Co A's retail arm was ordered to cease the conduct and implement compliance measures.

- Power Co A Group was ordered to pay surcharges totaling approximately JPY 26.78 million (around USD 180,000), which had been reduced by 30% due to cooperation with the investigation (under Japan's leniency-like cooperation system).

- Gas Co B, the incumbent, had applied for full immunity under Japan's leniency program (課徴金減免制度, kachōkin genmen seido) before the JFTC investigation began and thus faced no surcharges. This highlights the significant role of the leniency program in uncovering such cartels.

- Market Definition Point: Interestingly, legal commentary noted that the JFTC defined the relevant market very narrowly – specifically, the supply of gas to the 23 customer sites named in the agreement. Some questioned whether the underlying agreement might have been broader, perhaps an implicit understanding not to compete aggressively for any large customers in Gas Co B's territory. This narrower definition contrasts with broader geographic market definitions used by the JFTC in previous cartel cases involving power companies allegedly agreeing not to compete in each other's regional territories. The scope of the defined market can impact the calculation of surcharges and the breadth of the cease-and-desist order.

Action 2: Residential Gas & Electricity Pricing Coordination (Warning)

- The Concern: The JFTC issued a warning (警告, keikoku) – which is not a formal finding of violation but indicates serious concerns about potentially illegal conduct – to both Power Co A's retail arm and Gas Co B regarding suspected collusion around the time of the residential gas market liberalization in 2017.

- Alleged Conduct: The suspicion centered on communications regarding the setting and announcement of retail prices, particularly for bundled electricity and gas plans. Allegations included agreements on the sequence of price announcements (Gas Co B, the incumbent, announcing first, followed by Power Co A, the entrant, announcing a lower price) and, more critically, Power Co A allegedly requesting Gas Co B not to further reduce its prices below Power Co A's announced level after the launch.

- Potential Violation: If proven, such coordination could constitute an Unreasonable Restraint of Trade (AMA Article 3) by limiting price competition.

- Why Only a Warning? The JFTC did not issue formal orders. Legal commentary suggests this might be due to:

- Evidentiary Challenges: Difficulty in proving a firm, mutual agreement to fix or restrict prices, as opposed to unilateral requests or mere information exchange about timing. Proving the "mutual restraint of business activities" required for an AMA Article 3 violation can be hard without clear evidence of commitment.

- Market Dynamics: Assessing the actual competitive impact in the highly fluid, initial phase of market liberalization might have been complex.

Action 3: Post-FIT Solar Power Purchase Price Coordination (Warning)

- The Concern: A separate warning was issued to both companies concerning suspected collusion related to the prices they offered to residential customers for surplus electricity generated by solar panels after the mandatory purchase period under Japan's Feed-in-Tariff (FIT) system expired (relevant from late 2019 onwards).

- Alleged Conduct: Suspicions involved discussions about the timing of announcing their respective post-FIT purchase prices (with Power Co A allegedly agreeing to announce first) and Power Co A allegedly requesting Gas Co B not to set its purchase price "significantly higher" (大幅に上回る, ōhaba ni uwamawaru) than Power Co A's price.

- Potential Violation: This could potentially constitute an Unreasonable Restraint of Trade (AMA Article 3) aimed at suppressing the prices paid to residential solar power producers.

- Why Only a Warning? Similar to Action 2, the lack of a formal order likely stemmed from evidentiary issues. The alleged request regarding price levels ("not significantly higher") was inherently vague, making it difficult to establish a concrete price-fixing agreement or demonstrate a substantial restraint on competition based solely on this communication.

Action 4: Regional LNG Truck Delivery Collusion (Warning)

- The Concern: A third warning was issued, this time specifically to Power Co A Group entities (including its retail arm and an LNG subsidiary), concerning suspected collusion with Gas Co B in the market for supplying Liquefied Natural Gas (LNG) via tanker trucks to industrial/commercial customers within a specific three-prefecture region (Aichi, Gifu, Mie), from around 2019 onwards.

- Alleged Conduct: The suspicion involved an agreement to allocate customers within this specific regional LNG delivery market.

- Potential Violation: Customer allocation is a form of market division prohibited under AMA Article 3.

- Why Only a Warning? The JFTC's published summary explicitly noted the presence of other competitors in this particular LNG truck delivery market within the specified region. This suggests that while customer allocation among the implicated companies was suspected, the presence of alternative suppliers meant the alleged collusion might not have met the threshold of substantially restraining competition in the overall relevant market, thus justifying only a warning rather than a formal exclusion order.

Key Themes and Compliance Implications

These JFTC actions, viewed collectively, reveal several important themes and offer critical compliance lessons for businesses involved in Japan's energy markets:

- High Risk of "Transitional Collusion": Liberalization fundamentally changes market structures, creating strong incentives for former monopolists to find ways (legal or illegal) to manage the transition and limit the impact of new competition, especially from other large players. The JFTC is acutely aware of this risk and actively monitors interactions between incumbents and significant entrants.

- Scrutiny Beyond Explicit Agreements: While explicit bid rigging and customer allocation (Action 1) face the harshest penalties, the JFTC is also scrutinizing softer forms of potential coordination. Information exchanges, discussions about pricing strategies or timing, and even unilateral requests regarding a competitor's pricing (Actions 2 & 3) can trigger warnings if they appear aimed at dampening competition, even if a binding agreement isn't proven.

- Importance of Leniency: Gas Co B's successful leniency application in the industrial gas cartel case underscores the power of this tool in detecting hardcore violations. Companies should ensure their compliance programs adequately address the leniency system.

- Significance of Warnings: JFTC warnings (keikoku) should not be dismissed lightly. They represent formal expressions of serious concern by the authority regarding conduct that potentially violates the AMA. Companies receiving warnings are expected to cease the questioned behavior immediately and are likely subject to heightened future scrutiny. Failure to heed a warning significantly increases the risk of subsequent formal orders and penalties if the conduct continues or similar conduct recurs.

- Market Definition Matters: The JFTC's determination of the relevant market can influence the assessment of whether competition has been substantially restrained (as potentially seen in Action 4) and affects the calculation of surcharges in cartel cases.

- Compliance is Paramount: For all players – incumbents, new entrants, domestic firms, foreign subsidiaries – operating in Japan's dynamic energy markets, a robust and actively implemented antitrust compliance program is indispensable. Key elements include:

- Clear prohibitions on agreements or understandings with competitors concerning prices, output, customers, territories, or bids.

- Strict guidelines on information exchange with competitors, limiting discussions to legitimate pro-competitive purposes (if any) and avoiding sensitive topics like future pricing, costs, or customer strategies.

- Particular caution in communications between companies that were former monopolists in adjacent markets (power vs. gas) and are now competitors.

- Training for sales, marketing, and management personnel on antitrust risks specific to liberalized markets.

Conclusion: Navigating Competition in Japan's New Energy Landscape

The liberalization of Japan's energy markets promised increased efficiency and consumer benefits through competition. However, as the JFTC's recent enforcement actions demonstrate, the transition also creates significant risks of anticompetitive behavior aimed at preserving legacy market positions or muting price rivalry. The series of actions announced in March 2024 involving a major power group and a gas utility highlight the JFTC's commitment to policing these markets actively.

The lessons are clear: explicit cartels involving customer allocation or bid rigging will face formal orders and potentially significant fines (mitigated only by leniency). Furthermore, even communications or coordination falling short of hard proof of agreement – such as exchanges about pricing intentions, announcement timing, or requests concerning competitive responses – can trigger formal warnings if they raise serious competitive concerns. For all businesses participating in Japan's electricity and gas sectors, maintaining rigorous antitrust compliance is not merely a legal obligation but a critical component of sustainable business strategy in this evolving competitive environment.

- Japan Unleashes Record Fines: Analyzing the Landmark Electricity Market Cartel Case

- Balancing Decarbonization and Competition Law in Japan: Navigating Green Collaborations

- Antitrust Green Lights?: Navigating Sustainability Collaborations in Japan

- JFTC Cease-and-Desist & Surcharge Orders in City-Gas Cartel (Press Release, 4 Mar 2024)

- Electricity & Gas Market Surveillance Commission Annual Report 2024 (METI, PDF)